As modern health care continues to increase life expectancy, more elderly people than ever will need to depend upon other people who may or may not have their best interests at heart. In such cases, undue influence is a real threat that can be prevented or minimised with the help of our estate planning lawyers in Adelaide.

What Is Undue Influence?

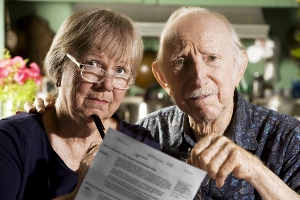

Undue influence occurs when an inequality of power exists between two parties in a relationship. In elder law, this is most frequently seen when a vulnerable elderly person creates an important legal document such as their Will or Power of Attorney in response to the influence by someone close to them. In such cases, advantage is taken of the elderly person’s declining physical health, independence, mobility or mental health to derive some benefit, such as inclusion in the Will, receipt of more than their fair share of the estate, or gifts and loans under Power of Attorney.

Why Are the Elderly Vulnerable to Financial Abuse and Undue Influence?

Vulnerability to undue influence can occur for many reasons. If a family member is the carer of an elderly person, long-standing family relationship conflicts may play a part. Additionally, meeting the needs of an elderly person is stressful, particularly if there is no respite care, and carers sometimes use this stress as a justification or excuse to take advantage of a person financially. The carer may see this as fair compensation for the heavy physical and emotional tolls they have suffered. Whether they keep the change after grocery shopping trips or push for a larger piece of the estate, they feel justified in doing so after giving up so much of their lives to care taking. This sense of entitlement is a dangerous precursor to abuse.

Other perpetrators of elder financial abuse have different motives, and merely see the elderly person as an easy target of opportunity. You may have seen such stories in the news, where “Dad” suddenly acquires a new “friend”. These people swoop in and create a relationship of dependence so that the elderly person feels beholden to them. Other abusers may have addictive behaviours or psychological conditions that drive them to take advantage of the weak and vulnerable.

Adelaide Wills Lawyers Who Are on Your Side

Last-minute changes in Wills raise suspicion in people’s minds, and are sometimes challenged in Australian courts. To obtain advice on changing your Will and ensure that your assets are properly protected, consult; with the trusted professionals at Genders & Partners. Our experienced estate planning and testamentary trust team in Adelaide offer a free initial phone consultation.

SPECIAL REPORT “7 Things You Must Know Before You Make Your Will”

In this report you will Learn:

Why home-made Wills can be a LOT more expensive than you might think.

The secret weapons used by the rich & powerful to protect their assets, and transfer their wealth two or three generations ahead.

How Estate and Trustee Companies make BIG money from “free” Wills.

The Most Common Estate Planning Mistakes, how they can cost your family a fortune, and How to Avoid Them.

The Elements of a Sound Estate Plan – why a Will alone is not enough.

How to Make Sure Your Assets Stay in Your Family and are not lost to creditors, lawsuits or ex-spouses.

How to guard against challenges to your Estate after you’re gone.