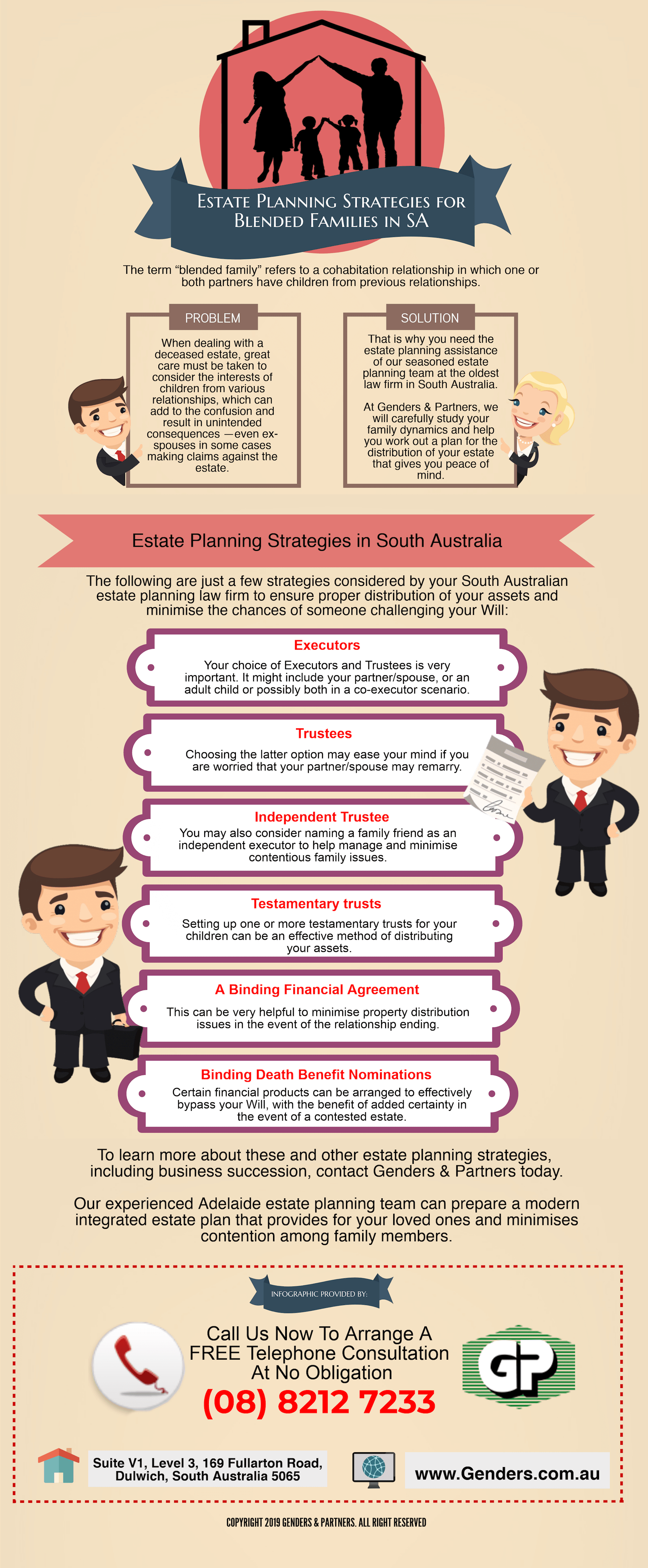

The term “blended family” refers to a cohabitation relationship in which one or both partners have children from previous relationships.

When dealing with a deceased estate, great care must be taken to consider the interests of children from various relationships, which can add to the confusion and result in unintended consequences —even ex-spouses in some cases making claims against the estate.

That is why you need the estate planning assistance of our seasoned estate planning team at the oldest law firm in South Australia.

At Genders & Partners, we will carefully study your family dynamics and help you work out a plan for the distribution of your estate that gives you peace of mind.

Estate Planning Strategies in South Australia

The following are just a few strategies considered by your South Australian estate planning law firm to ensure proper distribution of your assets and minimise the chances of someone challenging your Will:

Executors and Trustees

Your choice of Executors and Trustees is very important. It might include your partner/spouse, or an adult child or possibly both in a co-executor scenario.

Choosing the latter option may ease your mind if you are worried that your partner/spouse may remarry.

You may also consider naming a family friend as an independent executor to help manage and minimise contentious family issues.

Testamentary trusts:

Setting up one or more testamentary trusts for your children can be an effective method of distributing your assets.

A Binding Financial Agreement

This can be very helpful to minimise property distribution issues in the event of the relationship ending.

Binding Death Benefit Nominations

Certain financial products can be arranged to effectively bypass your Will, with the benefit of added certainty in the event of a contested estate.

To learn more about these and other estate planning strategies, including life insurance and business succession, contact Genders & Partners today.

Our experienced Adelaide estate planning team can prepare a modern integrated estate plan that provides for your loved ones and minimises contention among family members.

Request Your FREE 15 minute preliminary Telephone Consultation Today! Call us on (08) 8212 7233.

SPECIAL REPORT “7 Things You Must Know Before You Make Your Will”

In this report you will Learn:

Why home-made Wills can be a LOT more expensive than you might think.

The secret weapons used by the rich & powerful to protect their assets, and transfer their wealth two or three generations ahead.

How Estate and Trustee Companies make BIG money from “free” Wills.

The Most Common Estate Planning Mistakes, how they can cost your family a fortune, and How to Avoid Them.

The Elements of a Sound Estate Plan – why a Will alone is not enough.

How to Make Sure Your Assets Stay in Your Family and are not lost to creditors, lawsuits or ex-spouses.

How to guard against challenges to your Estate after you’re gone.