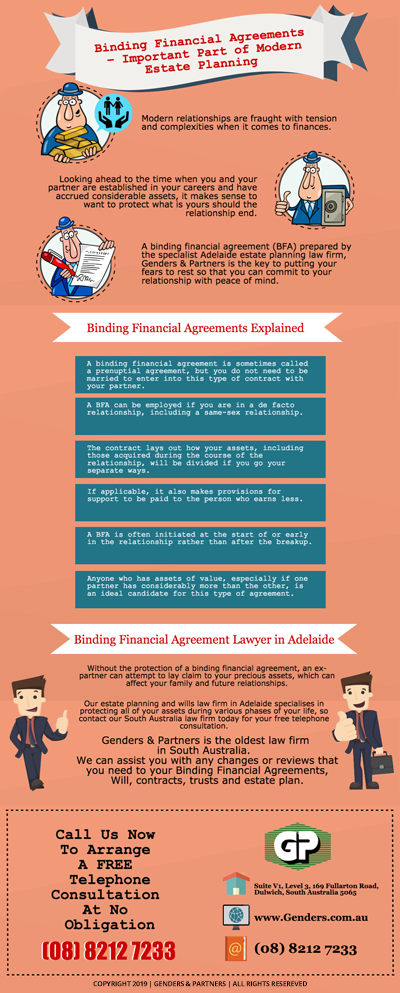

Modern relationships are fraught with tension and complexities when it comes to finances.

Looking ahead to the time when you and your partner are established in your careers and have accrued considerable assets, it makes sense to want to protect what is yours should the relationship end.

An unwillingness to commit too-deeply, too-soon is especially common if you’ve been destroyed emotionally & financially by a contentious breakup or divorce in the past.

A binding financial agreement (BFA) prepared by the specialist Adelaide estate planning law firm, Genders & Partners is the key to putting your fears to rest so that you can commit to your relationship with peace of mind.

Binding Financial Agreements Explained

- A binding financial agreement is sometimes called a prenuptial agreement, but you do not need to be married to enter into this type of contract with your partner.

- A BFA can be employed if you are in a de facto relationship, including a same-sex relationship.

- The contract lays out how your assets, including those acquired during the course of the relationship, will be divided if you go your separate ways.

- If applicable, it also makes provisions for support to be paid to the person who earns less.

- A BFA is often initiated at the start of or early in the relationship rather than after the breakup.

- Anyone who has assets of value, especially if one partner has considerably more than the other, is an ideal candidate for this type of agreement.

Binding Financial Agreement Lawyer in Adelaide

Without the protection of a binding financial agreement, an ex-partner can attempt to lay claim to your precious assets, which can affect your family and future relationships.

Our estate planning and wills law firm in Adelaide specialises in protecting all of your assets during various phases of your life, so contact our South Australia law firm today for your free telephone consultation.

Genders & Partners is the oldest law firm in South Australia. We can assist you with any changes or reviews that you need to your Binding Financial Agreements, Will, contracts, trusts and estate plan.

Request Your FREE 15 minute Telephone Consultation Today! Call us on (08) 8212 7233

SPECIAL REPORT “7 Things You Must Know Before You Make Your Will”

In this report you will Learn:

Why home-made Wills can be a LOT more expensive than you might think.

The secret weapons used by the rich & powerful to protect their assets, and transfer their wealth two or three generations ahead.

How Estate and Trustee Companies make BIG money from “free” Wills.

The Most Common Estate Planning Mistakes, how they can cost your family a fortune, and How to Avoid Them.

The Elements of a Sound Estate Plan – why a Will alone is not enough.

How to Make Sure Your Assets Stay in Your Family and are not lost to creditors, lawsuits or ex-spouses.

How to guard against challenges to your Estate after you’re gone.