Estate Planning Challenges Experienced By Blended Families

To find this video on our Youtube Channel, please click the link below:

Estate Planning Challenges Experienced By Blended Families

Oldest Law Firm in South Australia - Founded 1848 | (08) 8212 7233

To find this video on our Youtube Channel, please click the link below:

Estate Planning Challenges Experienced By Blended Families

Contact Genders and Partners today on (08) 8212 7233 to arrange a FREE telephone consultation and to request a FREE copy of our special Report: “7 Things You Must Know About Wills and Estate Planning”. Genders and Partners is located at Suite V1, Level 3, 169 Fullarton Road Dulwich, South Australia 5065

In a 2014 Judgment, the Supreme Court of Queensland ruled that the administrator of a deceased estate breached her fiduciary duty by applying for her deceased son’s superannuation benefits to be paid to her personally, rather than on behalf of his estate.

This is an example of where a little knowledge can be a dangerous thing. Probate and Deceased Estate administration is a specialised area of law. Don’t be fooled into believing the lady at the hairdresser or the bloke down the pub who says that it is easy to do this yourself, or that the lawyer who handled your divorce, or your uncle’s drink-driving offence, can easily do this. If you pay peanuts, you’re very likely to get monkeys.

Contact Genders and Partners today on (08) 8212 7233 to arrange a FREE telephone consultation and to request a FREE copy of our special Report: “7 Things You Must Know About Wills and Estate Planning”. Genders and Partners is located at Suite V1, Level 3, 169 Fullarton Road, Dulwich, SA 5065

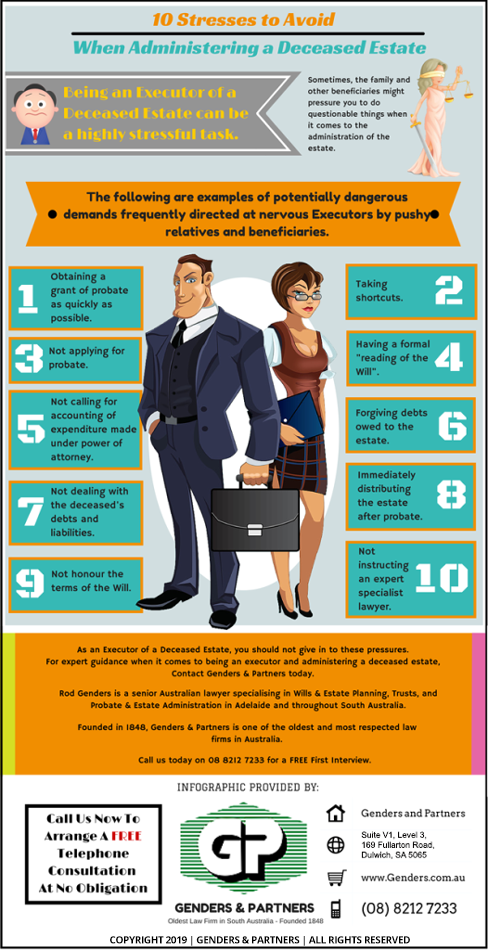

An executor of a deceased estate in Adelaide is responsible for administering the estate according to the terms of the Will and ensuring that all taxes and debts are paid. Trustees of a deceased estate, on the other hand, often have a longer and more complicated job that in some cases can last for years or even decades.

If you have been appointed as a trustee of a testamentary trust, you have certain legal requirements to uphold, and any failure to comply can leave you personally liable for financial losses suffered.

The best way to ensure that you understand your responsibilities and carry them out appropriately is to consult with a specialist Adelaide probate and estate administration law firm as soon as possible.

You can think of a trust as a type of container. Inside the container is something to be protected. This is called the trust fund. It is being held in safekeeping for the benefit of one or more people or entities, called beneficiaries.

A trustee is appointed to take control of the trust until a future date, at which time the trust fund is passed on to the beneficiaries. The trustee can be an individual or a private company appointed by the deceased.

If you are in a business with shareholders, your business faces a major potential threat if one of your fellow shareholders dies or becomes permanently incapacitated.

Business Succession Planning is part of modern integrated estate planning, and your interest in your business may be a substantial part of your personal net worth. Good planning through buy/sell agreements and appropriate insurance can make all the difference. For many businesses, if no pre-existing arrangements are in place, the death of a shareholder can mean their shares in the company will go to the beneficiaries of that person’s deceased estate.