Rod Genders is a senior Australian lawyer specialising in Wills and Estate Planning, Probate and Estate Administration, Trusts and Guardianship and Inheritance Claims and Contested Estates in South Australia. His boutique specialist law firm, which was founded on 1848, is one of the oldest and most respected in Australia. Rod is an international author and speaker. Rod is the 3rd generation of Genders in the law and has been practising specialised law since the mid 80’s. He has acted as counsel or consultant to in excess of 50 other firms around Australia. Rod holds the SA state record for the highest ever personal injury award of damages, and has been involved in several of the largest personal injury claims in Australian legal history. For over 10 years he served on the Council of the Law Society of South Australia and is a senior member of its Succession Law Committee. Rod was a founding committee member of the South Australian branch of the London-based Society of Trusts and Estate Practitioners (STEP) for 8 years and was the founding Chair of the international STEP Digital Assets Special Interest Group. For over 25 years Rod has chaired a private committee enquiring into the affairs of protected persons. He is a member of the Law Council of Australia, and a member of its Succession and Elder Law Committee.

From Wills & estate planning to probate & deceased estates in Adelaide, Genders & Partners has a proven track record of handling challenging scenarios discreetly, efficiently and effectively.

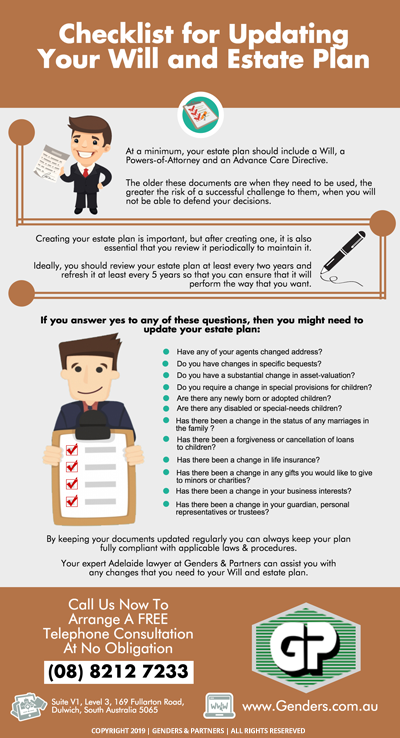

It is important for every adult person to create an Advance Care Directive to maximise their independence, dignity and quality of life.

Personal values, religious and cultural preferences can be recorded for when a person loses the ability to make decisions about their own accommodation and healthcare, including end-of-life decisions.

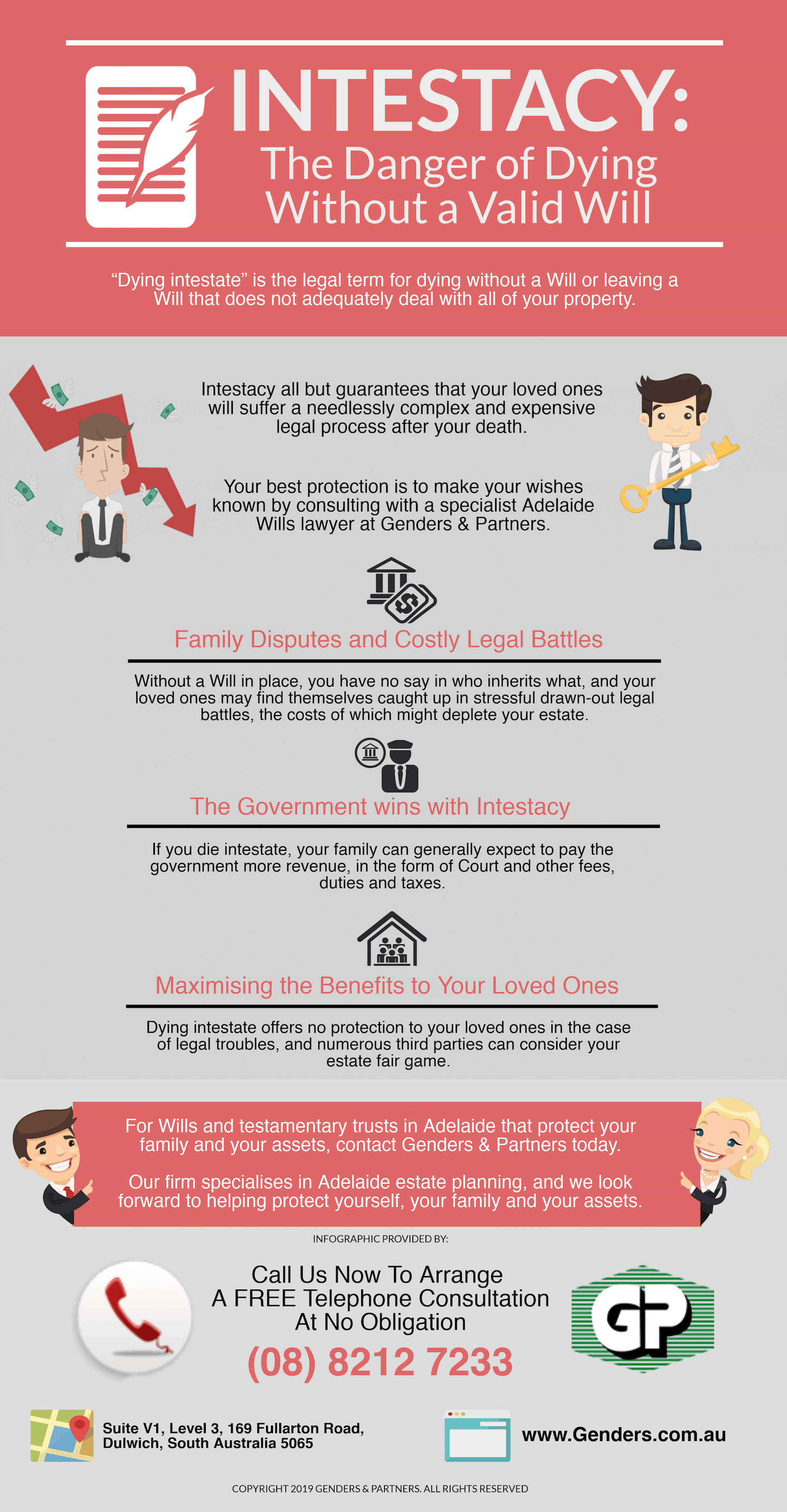

You can save yourself and your loved-ones lots of time, money & grief by consulting a specialist estate planning law firm to help create and maintain your Estate Plan in Adelaide. By doing this, you will likely reduce the expense of the administration of your deceased estate.