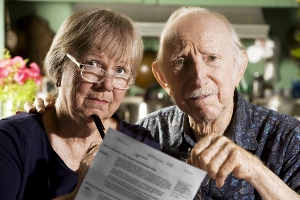

Undue Influence and the Growing Problem of Elder Abuse

Elder abuse can take many forms, including neglect, verbal and physical abuse, and financial abuse. According to the United Nations Office of the High Commissioner for Human Rights, people who are aged 80 and older suffer two to three times the abuse rate of those in younger age brackets.

As modern health care continues to increase life expectancy, more elderly people than ever will need to depend upon other people who may or may not have their best interests at heart. In such cases, undue influence is a real threat that can be prevented or minimised with the help of our estate planning lawyers in Adelaide.