Who and how to appoint an Executor in your Will in South Australia

Choosing who will take on the role of Executor of your Will can sometimes be challenging.

Most Will-makers (aka ‘Testators’) appoint a trusted friend or family member as their executor. This person will end up playing a very important role, with a lot of responsibility.

If they instruct an experienced lawyer who specialises in Wills and Estates, then most of the ‘heavy-lifting’ will be done for them by the lawyer.

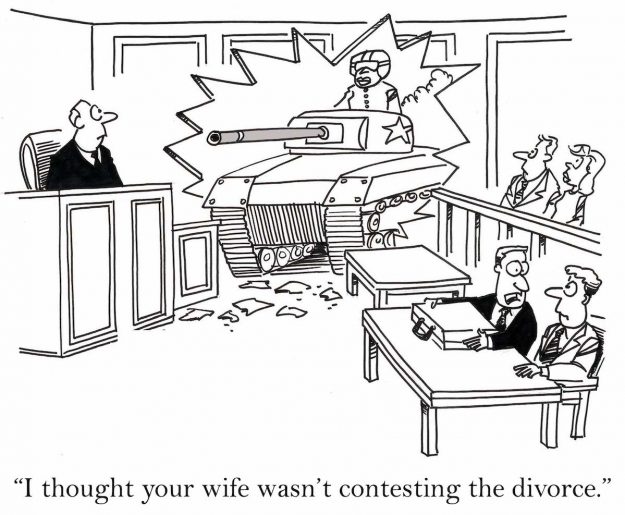

In this age of political correctness, it seems that humour is a dangerous occupation. Each joke must be carefully scrutinised for potential offence to some minority group, and then sanitised of any disrespect to anyone whose delicate sensibilities might be burdened with the weight of somebody laughing at their expense.

In this age of political correctness, it seems that humour is a dangerous occupation. Each joke must be carefully scrutinised for potential offence to some minority group, and then sanitised of any disrespect to anyone whose delicate sensibilities might be burdened with the weight of somebody laughing at their expense.