You only have to look at the newsfeeds and internet chat forums to see that people are talking about the increasing numbers of challenges to Wills and deceased estates nowadays.

Here are the seven main reasons why:

No Will

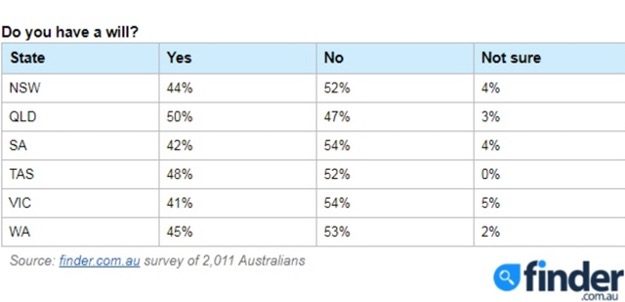

Recent research reveals 52 per cent of adult Australians don’t have a Will.

The majority of Australians are letting their families down in one key area — more than half of Australian adults don’t have a Will, even though it could mean their families are left out in the cold in the event of their death.

That’s the alarming finding of a recent survey conducted by comparison sitefinder.com.au, which revealed 52 per cent of us — or 9.9 million Australians — have not prepared the vital legal document.

The survey found 34 per cent of the population just haven’t gotten around to it yet.

Meanwhile, 14 per cent said they didn’t own enough assets or have enough wealth to justify the effort involved.

Worryingly, four per cent said they just don’t want a Will — even though dying without one could mean leaving loved ones in the lurch, as their estate would then be distributed solely according to intestacy law and not according to their wishes.

One in seven people falsely believed a Will was only necessary for people who have a large estate.

Most people don’t like to think about their death and fewer still enjoy paperwork, but if you die without making a valid Will, your assets could be distributed to people whom you would not choose.

When a person dies without a Will, assets will usually be divided between their spouse and children once debts, taxes and funeral expenses are paid. However that leaves plenty of scope for dispute and distress, as well as a lot more expense to be incurred trying to fix the mess left behind.

Without the guidance of a well-drafted Will, estate litigation is far more likely, especially as each person may have their own views and preferences as to what ought to be done.

Increased financial pressure

Financial stress has always been a motivating factor for family members to challenge Wills and estates of recently-deceased family members.

However the recent effects of COVID, together with rising inflation, house prices and mortgage repayments, have all added to the pressure.

Desperate people do desperate things. And a pot of ‘free money’ in a deceased estate makes for a very tempting target for a lot of people.

Blended families

Since the 1970’s in Australia (when no-fault divorce became available) the number of ‘blended families’ has skyrocketed.

This is where there are children from prior relationships. This situation hugely increases the complexity of estate planning, as well as the likelihood of litigation following the death of a parent.

Couples in a nuclear family (where both are the biological parents of all of the children) typically have simpler estate-planning requirements: often it is leaving everything to the surviving spouse, and if they are both gone, then everything to the children equally between them.

While this sort of ‘I love you’ Will is not proof against litigation, it is far less likely to be attacked.

However, if couples in a blended family attempt this sort of simple ‘I love you’ Will, then they are almost guaranteeing litigation, because the adult children from the first relationship will be effectively forced to litigate against their step-parent following the death of their natural parent.

The reason for this difference is because, in a nuclear family the children can afford to wait until the death of the other parent, relatively confident that they will receive something when the other parent eventually dies. In other words, the kids wait their turn.

Contrast this with the blended family, where the natural parent dies. The other parent is not the biological parent of some of the children, and those children cannot afford to ‘wait and see’ if their step-parent leaves them anything in the fullness of time.

Their only recourse is to challenge the estate of their biological parent – and they must do it quickly, or risk having their claim statute-barred.

DIY Wills

For about a decade on Australian television, every insurance advertisement ended with the phrase “… and you get a free legal Will kit…” This led a generation of Australians to mistakenly believe that it was safe and easy to make your own Will.

Unfortunately there are many traps for the unwary with DIY Wills, but the mistakes you make won’t become apparent until after you die, and it’s then too late to fix them.

Consequently, bodgy dodgy Wills are a big cause of increasing estate litigation.

Things are likely to get worse with the rise of online Wills. It is fitting that Dracula is being used to advertise one of these companies!

The Internet

The internet has made more information more accessible. People are more informed (not always correctly-informed) about their rights and entitlements, and so people (especially younger people) are far more aware nowadays of the availability of remedies such as Family Provision claims, than previous generations of ordinary Australians.

One the one hand, it could be a good thing that people are more informed and aware of their rights. On the other hand, the explosion of litigation relating to deceased estates is not an attractive quality for modern society.

Hopefully a balance can be found to protect the rights of the deserving without encouraging USA-style of litigiousness.

Ageing population and the rise of dementia

A hundred years ago, when the age-pension was first introduced in Australia, the eligibility age was set at 65, at a time when the average male life expectancy was only 62. Most men were not expected to live long enough to claim the pension!

In 2022, the average life expectancy is nearly 83. However, while we are living longer, we are also more likely to suffer a decline in our mental capacity, due to the large rise in dementia.

When people with diminished capacity make Wills, there can be a suspicion that they might not fully understand the consequences of their actions.

Older people can sometimes be more vulnerable to the undue influence of ‘gold-diggers’. These factors all contribute to the increase in challenges to Wills made by older people whose health may be suspect.

Not keeping Will up to date

Wills are not ‘set and forget’, but too many people think they can make a Will when they first get married, and then never think about it again.

Life circumstances change. People come into and out of our lives. Laws change.

Relying on a Will that is more than 5-7 years old at the date of your death, increases the chances that – if a challenge is made – the Court will be more likely to conclude that the out-of-date document no longer accurately reflects the deceased’s testamentary intentions, and thus it increase the prospects of a successful challenge.

There is value in keeping your Will up to date.

What you can do

Reviewing and updating your estate planning documents when there is a significant change in your life is crucial.

Genders and Partners is the oldest law firm in South Australia, established 1848.

Contact us to learn how to protect yourself, your family and your assets through modern integrated estate planning solutions, by visiting our website today and schedule a free no obligation telephone consultation to find out how they can help you and yours.

Remember – any mistakes you make in your estate planning documents won’t become apparent until after it’s too late for you to fix them. Get proper advice, and do it right.

It is also vitally important that you keep your estate plan up to date – it is not a set-and-forget exercise.

To learn how to protect yourself, your family and your assets, by creating a professionally-made estate plan, claim your FREE 15 minute Telephone Consultation

eBook “7 Things You Must Know Before You Make Your Will”

In this eBook you will Learn:

Why home-made Wills can be a LOT more expensive than you might think.

The secret weapons used by the rich & powerful to protect their assets, and transfer their wealth two or three generations ahead.

How Estate and Trustee Companies make BIG money from “free” Wills.

The Most Common Estate Planning Mistakes, how they can cost your family a fortune, and How to Avoid Them.

The Elements of a Sound Estate Plan – why a Will alone is not enough.

How to Make Sure Your Assets Stay in Your Family and are not lost to creditors, lawsuits or ex-spouses.

How to guard against challenges to your Estate after you’re gone.